Gotek Group: Expert Opinion

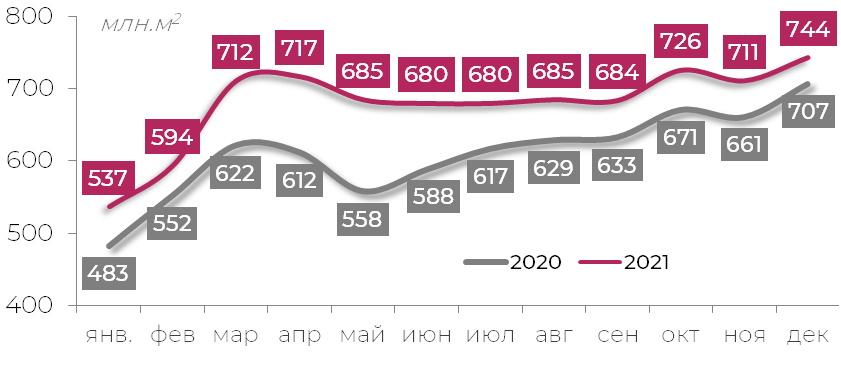

Transformation vectors that emerged in the market of corrugated board packaging in the past year continue to affect its dynamics, which at the end of the first half of the year amounted to 15%. Positive development of corrugated board market was accompanied by another equally significant trend: half-year "rally" of prices for cartonboard showed the increase of 150-200%.

Yury Alpeev, director for strategic marketing of the Gotek Group, chairman of the expert council NCPack comments the current market situation and forecasts until the end of the year.

"Since the beginning of the year, prices for corrugated packaging have been growing very dynamically. In June the cost of T-23 corrugated cardboard reached 36 rubles per square meter. The driver was the growth of prices for containerboard and waste paper by a factor of over 1.5. Therefore, it is natural to see growing prices for packaging.

What caused the rapid price hike for raw materials?

Prices for recycled containerboard (RCB) in June showed an increase of +60% compared to January of this year, being under the pressure of the factor of continuous growth of the price for waste paper, which in May of this year increased by 50% compared to January. This happened due to imbalance of supply and demand for it, associated with high growth rate of corrugated packaging market (+15% during the first half of the year) and lagging behind the dynamics of collection of waste paper of MS-5B grade.

In addition to internal factors, external events also exerted pressure on prices. Global inflation accelerated growth of prices in the world markets. The growth of the cost of containerboard abroad was no less powerful than in Russia. However, in April-May our prices for raw materials exceeded even European prices: MC-5B is more expensive in Russia by 36,5%, flat cardboard - by 4,6%, cellulose containerboard - by 1%.

Growth of prices for containerboard and lack of restraining competitive factors from the rapidly growing packaging market determined the dynamics of prices for corrugated packaging.

For the market of corrugated board packaging the growth rate of 15-20% is significantly higher than average values that were typical for the industry development in the last 10 years (+5-7%), especially if we take into account that such dynamics was formed in the conditions of the coronary crisis. All past "crises" led to a drop in demand and, consequently, in production. But in this case, new trends began to operate, which were stimulated into additional development in the period of the economy of social distancing. Significant importance in this period was played by changes in the structure and patterns of consumption, prioritizing the choice of channels for making purchases.

The remaining restrictions on cross-border movement of the population contributed to the growth of domestic consumption. From January to May, retail turnover grew by 18% YoY, including online shopping by 33%. The increase in spending on food, which amounted to +6% from January to June 2020, stabilized at +5% in the same period of 2021. At the same time, demand shifted to non-food products (+10% y/y, January-June). Manufacturing industries, against the backdrop of stagnating economy, also continued to increase production: food (January-May 2021/2020 +2.4%), non-food (January-May 2021/2020 +11%).

The above factors created a multiplier effect, which determined the growth in demand for packaging materials.

Changes in the structure of consumption affected almost all generations and dramatically accelerated the development of some trends. Consumption is becoming more sensible. People are getting acquainted with the product in the digital space, making purchase decisions in a more balanced way. Changes in consumer preferences have stimulated the development of new channels for shopping: omni-channel choice, a hybrid retail model (offline-online), marketplaces that provide smart delivery management, the development of discounters, minimarkets, the convenience stores format.

All this leads to the expansion of the packaging range. Now the industry is even more actively involved in trade promotions and co-promotional/marketing events. Requirements for deadlines for development of new packaging solutions become tougher, packaging segment for online trade and marketplaces sees faster development.

All of these factors in combination create the conditions for growth of the corrugated packaging market in 2021 by 11% to 8.2 billion sq.m. Accordingly the growth by the end of the year will amount to 0.8 billion sq. m. if the current situation remains unchanged. In case the second half of the year sees factors "playing" to lower the dynamics (e.g., lifted travel restrictions, and the 1.8 trillion rubles, which were traditionally taken travelling, will leave the country), the growth is expected to be more modest. Of course, this will also affect prices.

Another risk factor that will have a significant impact on the market situation is the growth in the capacity utilization for the production of pulp and containerboard, which, according to our estimates, will be close to 92% by the end of the year. We call such utilization critical, because in case of further growth a deficit of raw material supply begins to form. This will deprive many major players of the possibility of seasonal maneuvering. Then, as a consequentially, not all orders will be accepted, and prices for finished products will rise. We already observed similar scenario in May and June.

We see the potential of the packaging market not in the continuous increase of capacities (there are enough of these in our market), but in meeting the needs of consumers, in adaptability to the challenges of our time, in quick reaction to the changing needs. New trends will be reflected in packaging as a product, transforming and focusing the activities of manufacturers in the direction of additional services, providing the partner function in the implementation of the client's goals.